Elevate Your

Wealth with Intelligent

Financial Moves

The first rule of wealth creation is protecting your capital; profits come only when losses are controlled.

Training Class Structure

Saturday & Sunday – Theory Classes - 10:00 AM - 04:00 PM

Monday & Tuesday – Live Market Classes - 09:00 AM - 01:00 PM

The Power of Patience in Trading

In the stock market, patience is a trader’s greatest strength. By waiting for the right opportunity that aligns with your strategy, risk management, and market conditions, you avoid emotional decisions and increase the chances of taking high-probability trades instead of forcing unnecessary ones.

Less noise, more conviction

True investing success comes from having clear understanding and conviction in what you invest in—knowing the business, risk, and potential rather than relying on excessive diversification or taking constant action, which often leads to confusion and diluted returns.

Trading Basics

Why Share Market Training Is Important Before Taking Your First Trade

Why Share Market Training Is Important Before Taking Your First Trade By...

Continue ReadingHow to Identify Momentum Stocks & How to Trade Them in the Indian Share Market

How to Identify Momentum Stocks & How to Trade Them in the...

Continue ReadingTrend Following Strategies: How to Buy & Sell Sensex with the Trend

Trend Following Strategies: How to Buy & Sell Sensex with the Trend...

Continue Reading

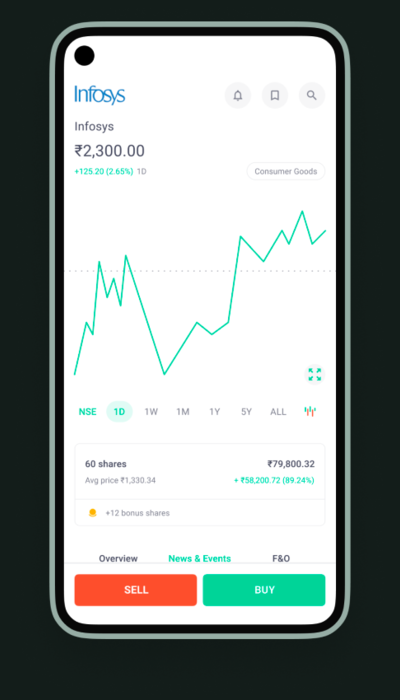

Low spreads on more than 150 instruments

Market Leaders

You don’t need to trade every move—wait for high-probability setups and trade with conviction.

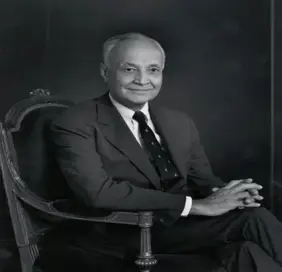

John Templeton

See the investment world as an ocean and buy where you get the most value for your money.

Frequently Asked Question

Trading is the act of buying and selling financial instruments like stocks to make profits from price movements over a short or medium period.Traders aim to buy at a lower price and sell at a higher price (or vice versa) by analyzing market trends, price action, and risk.

To get started with trading, first learn the basics of how the stock market works. Choose one trading style (intraday, swing, or positional) and open a trading & demat account with a registered broker. Start with paper trading or small capital, follow one simple strategy, and always use a stop loss. Focus on risk management, control your emotions, and review every trade to improve.

You can stay updated on market news and trends by following reliable sources daily and building a simple routine: • Track market news through financial websites and apps • Follow index movement, sectors, and top gainers/losers • Use charts to observe trends and volume • Watch economic events, results, and global markets • Maintain a daily market review habit Consistent observation of news + charts helps you understand market direction and momentum better.

Here are the main types of trading, explained simply: 1. Intraday Trading Buying and selling stocks on the same day to profit from short-term price movements. 2. Scalping Very short-term trades that capture small, quick price moves within minutes. 3. Swing Trading Holding trades for a few days to weeks to benefit from short-term trends. 4. Positional Trading Holding trades for weeks or months based on bigger market trends. 5. Delivery / Investing Buying stocks for long-term growth and holding them for years. Each type suits different time availability, risk level, and mindset.

It requires discipline, patience, emotional control, and continuous learning. People who expect quick money, cannot manage risk, or struggle with stress may find trading difficult. Trading suits those who are willing to learn properly, follow rules, accept losses, and stay consistent.

Fundamental analysis is the method of evaluating a stock by analyzing a company’s financial health, business performance, and economic factors to find its true value. It involves studying: • Company financials (revenue, profit, balance sheet) • Business model & management • Industry and sector growth • Economic and market conditions Fundamental analysis helps investors decide which stocks to buy for long-term investment and whether a stock is undervalued or overvalued.

Trading involves several risks that every trader should understand: • Market risk – Prices can move suddenly due to news or events • Loss of capital – Poor decisions or no stop loss can lead to losses • Emotional risk – Fear, greed, and overconfidence affect decisions • Over-trading risk – Too many trades reduce discipline and capital • Leverage risk – Using high leverage can increase losses quickly Proper risk management, discipline, and continuous learning help reduce these risks.

I am not SEBI registered. My insights are based on over 10 years of practical experience in the Indian stock market and are for educational purposes only.

Trading is profitable for me, but teaching comes from a different motivation. After more than 10 years of practical experience in the Indian stock market, I’ve learned that knowledge grows when it’s shared. Teaching allows me to help others avoid common mistakes, shorten their learning curve, and approach the market with discipline and risk management. I continue trading while teaching—education is about impact and contribution, not a replacement for trading.

I teach practical aspects of the Indian stock market, including market structure, price action, technical analysis, risk management, trading psychology, and disciplined trading strategies based on real-world experience. My focus is on helping learners understand how markets work and how to approach trading responsibly. All training is strictly for educational purposes.

The training is a 4-day classroom program conducted on Saturday, Sunday, Monday, and Tuesday, consisting of 2 days of theory sessions and 2 days of live workshop training.

No

Once payment is made, it is non-refundable under any circumstances. After attending the classes, the fee will not be refunded. If a participant is unable to attend any session, they may join the remaining sessions in the next available batch. Alternatively, if classes are not attended as scheduled, the participant may reschedule to a future batch, subject to availability.

What people say

"The classes were very clear and practical. I understood market structure and live trading concepts easily. The trainer explains patiently and answers every doubt.

Ramya Krishnan

Marketing Director

"Excellent learning experience. The trainer’s knowledge and real-time market explanation helped me gain confidence in trading.

Viswanathan

Account Executive

"Very well-structured classes from basics to advanced. Live market sessions made a big difference in my understanding.

Rakesh

Medical Assistant

"The classroom environment is comfortable and focused. Concepts are explained with real chart examples, which made learning easy.

Mohammed

Marketing Director

"I learned proper risk management and discipline here. The trainer focuses on long-term success, not shortcuts.

Casey Antony

President of SalesRegister For Next Batch Training

CLASS STRUCTURE

🗓 Saturday & Sunday – Theory Classes

10:00 AM - 04:00 PM

🗓 Monday & Tuesday – Live Market Classes

09:00 AM - 01:00 PM

WHAT YOU WILL LEARN

✔ Decode Market Structure

✔ Advanced Scalping Techniques

✔ Indicator-based trading strategies

✔ AI prompts for selecting stocks